Market Update: November 2022

An Update on the New Construction Pipeline

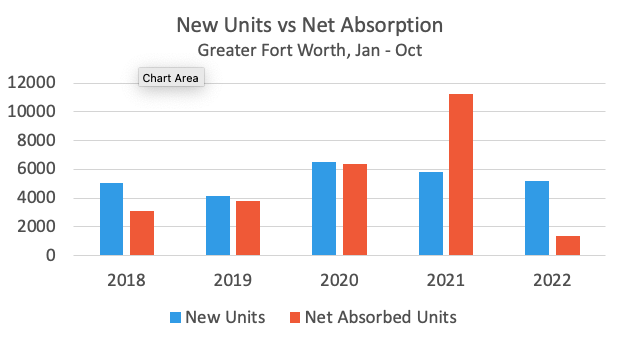

Despite the worst net absorption through October in more than a decade, Greater Fort Worth's average effective rent growth for new leases this year closed October just a hair short of a 10% gain. A small reduction in new supply volume has been a slight help to offset the resulting average occupancy decline, but not by much. With macroeconomic headwinds continuing to increase, new supply may play a more prominent role in industry performance in the coming year - so it’s a good time to check in on the new construction pipeline.

Average Construction Duration

ALN measures construction duration as the amount of time between a construction start date and a lease start date. Construction times have continued to grow this year, and Greater Fort Worth has been no exception. After managing to hold steady at 14 months on average for properties that began leasing last year, this year has seen a further increase up to more than 15 months for properties that began leasing in 2022. Even so, Greater Fort Worth has managed to stay well below the 20-month average construction duration for this year at the national level.

Recent Deliveries

About 5,200 new units have been delivered across Greater Fort Worth through October of this year. This volume of new supply represented a decline from both 2020 and 2021 but was only marginally below the three-year average of 5,500 new units established during the same portion of the calendar from 2019 through 2021.

Only half of the 12 ALN submarkets for the Greater Fort Worth region have seen any level of new supply so far this year. With just over 1,500 newly delivered units, the North Fort Worth submarket has led the way. Following up with a little more than 1,300 new units was the Denton – Corinth area, and third-most was the almost 1,000 new units in the South Fort Worth submarket.

Both South Arlington and North Arlington have had some new supply so far this year, to the tune of about 800 and 500 units respectively.

Units Under Construction

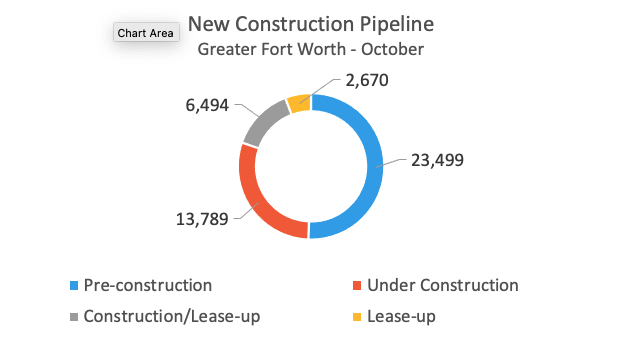

ALN was tracking close to 14,000 units under construction but not yet leasing at the end of October across Greater Fort Worth – up considerably from the volume recorded earlier in the year. Nine submarkets had at least one project under construction in October, so upcoming deliveries are set to be more widely dispersed geographically than recent deliveries.

The Central Fort Worth and North Fort Worth submarkets were really in a category of their own with right around 3,000 units under construction for each. The approximately 2,200 units under construction in the Denton – Corinth area were third-most and made that submarket the only other one with at least 2,000 units currently being built.

Other notable portions of the market included South Arlington and South Fort Worth, with roughly 1,900 and 1,500 units under construction respectively.

Pre-Construction

Projects in this group are those that are somewhere in the development process but haven’t broken ground. Because it’s possible to postpone or cancel these projects based on market conditions, they aren’t as relevant in the short term from a supply perspective. However, they can provide some insight into the general expectations for a market. About 24,000 units were in this phase of the pipeline to close in October – equal to 50% of the overall pipeline.

11 of 12 Greater Fort Worth submarkets had at least one project in a pre-construction phase to end the period, indicating that the greater geographic range of upcoming deliveries will not just be a temporary blip applying only to the next 18 months or so for projects already under construction.

The top three submarkets for this phase of the pipeline are the same as from the last phase: North Fort Worth, South Fort Worth, and Denton – Corinth. Almost 60% of pre-construction units are located in just these three submarkets with the 5,400 units for North Fort Worth leading the way. One area that has yet to be mentioned is the Grapevine – Roanoke – Keller submarket. That region had about 1,200 units in the pre-construction phase of the pipeline to close in October.

Takeaways

This year’s tepid apartment demand has not yet offset the average occupancy gains from last year for Greater Fort Worth multifamily – but that margin was down to only 100 basis points at the end of October. New supply has been within the typical range this year, but the construction pipeline is expected to increase its output over the next couple of years as all of nearly 14,000 units that are currently under construction are likely to begin leasing within the next 18 months or so.

With little reason to anticipate a material improvement in apartment demand at least until spring, macroeconomic and seasonal headwinds are likely to continue to pressure market-level average occupancy in the near term.

Jordan Brooks

Senior Market Analyst – ALN Apartment Data

Jordan@alndata.com

www.alndata.com

Jordan Brooks is a Senior Market Analyst at ALN Apartment Data. In addition to speaking at affiliates around the country, Jordan writes ALN’s monthly newsletter analyzes various aspects of the industry performance, and contributes monthly to multiple multifamily publications. He earned a master’s degree from the University of Texas at Dallas in Business Analytics.